The Bank of England is expected to raise interest rates to their highest level since 2008 on Thursday following official data last month that showed inflation remained stubbornly high.

The expected increase in the cost of borrowing would represent the central bank’s 12th consecutive increase since it began raising rates in December 2021. It follows similar moves by the US Federal Reserve and European Central Bank .

Economists will look beyond the rate decision in the message from the Monetary Policy Committee, which was finely balanced on future tightening at the last meeting in March, and its new economic forecasts to try to gauge how interest rates could rise further.

How much should the MPC raise rates?

Economists and markets are almost universally expecting a quarter percentage point increase from 4.25% to 4.5%.

The rise was far from a foregone conclusion after the March MPC meeting, when the committee said it would continue to monitor “evidence of a more persistent [inflationary] pressures” before raising interest rate Again.

But over the past month, official data showed inflation in March was 10.1%, well above the BoE‘s forecast made in February when he expected a drop to 9.2%. Combined with a resumption of wage pressures and stronger economic data, economists believe the threshold of evidence has been met.

Bruna Skarica, UK economist at Morgan Stanley, said she thought the inflation numbers were a game-changer with “the stickiness of basic goods [inflation]despite fairly sluggish retail volumes.”

George Buckley, chief UK economist at Nomura, said the chances of the BoE doing anything other than raise rates by 25 basis points were “very small”. He added: “Prices suggest markets are thinking the same.”

What will happen to the BoE forecasts?

The starting point for the BoE will be the higher than expected inflation rate for the month of March. Officials should still expect price pressures to ease quickly in 2023, with last year’s sharp rise in energy prices falling out of the annual comparison.

Although the initial inflation rate in the May forecast is worse, weaker-than-expected energy prices will lower the MPC’s inflation expectations even faster than expected in February. This, in turn, would increase household incomes.

The spot price for natural gas is now 82p per therm, less than half the market price of 189p the BoE used for 2023 in its February forecast. For the end of 2024, the current futures price is 147p per therm instead of 174p three months ago.

Buckley said falling energy prices would allow the BoE to drop its forecast that the economy would fall into recession this year.

But an improving outlook would also pose a problem for the central bank as it would have to explain why it is raising interest rates when its model’s central forecast is expected to show weaker inflationary pressures over the medium term.

Officials will justify this approach by pointing to signs of “second-round” effects – economists’ jargon for what most people call a wage-price spiral. But these are not well defined in the BoE model, and Jumana Saleheen, chief economist at Vanguard Europe, said some members of the MPC had “underestimated the transmission of [recent] high rates of inflation taking root in the economy”.

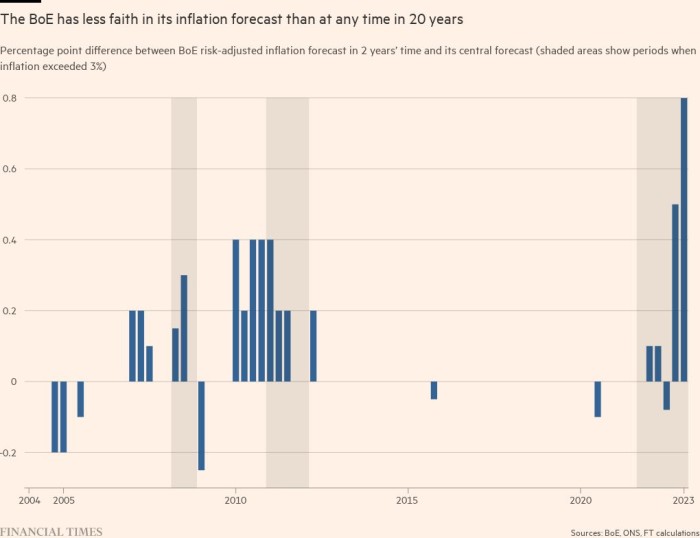

Problems with the central bank’s model became apparent in February, when officials decided to add 0.8 percentage points to its output to produce what they called a function-weighted “arithmetic mean” forecast. risks. This approach led to the largest deviation ever recorded from the MPC’s central forecast.

Economists believe the adjustment factor this time around could be even larger, reflecting concerns from some committee members that high inflation is becoming more entrenched in everyday life and corporate pricing decisions.

Will the central bank’s guidance change?

Certainly, the MPC will not want to tie its hands and rule out future interest rate hikes. Officials are expected to signal that future interest rate moves would be “data dependent” and that there was no bias to tighten policy further or reverse the trend and lower rates.

MPC members are increasingly concerned about the threat posed by a price-wage spiral. Late last month, BoE chief economist Huw Pill told households and businesses that they “have to accept” that they were poorer due to rising energy prices. Central bank officials said they were closely watching corporate pricing decisions.

Ashley Webb, UK economist at Capital Economics, said the MPC should have communicated the need to make borrowing for businesses and households more expensive rather than urging people not to ask for pay rises or seek defend profit margins.

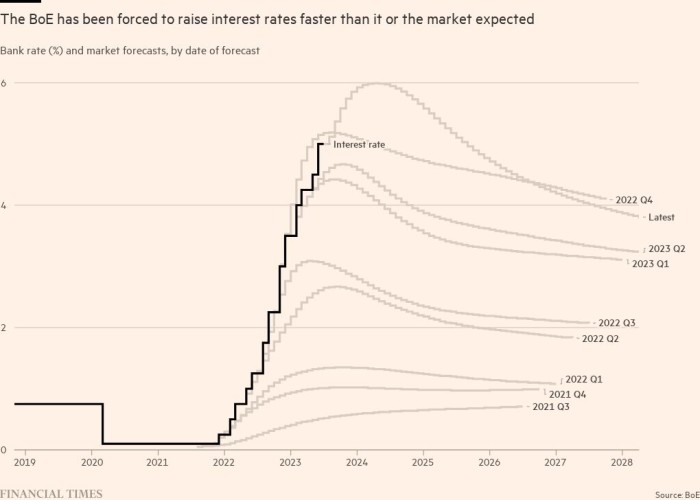

“Since the bank started raising interest rates from 0.1% in December 2021 to 4.25% now, it has consistently warned that rates will not rise very far. If the bank had seemed more hawkish, perhaps price and wage expectations would have fallen even further,” he said.

Given the uncertainties, the MPC is also likely to talk about the risks it faces regardless of its decision on interest rates.

“The MPC has always taken a risk-based approach, or at least should have done so ‘in an effort’ to minimize the likelihood of large and persistent errors,” said Jagjit Chadha, director of the National Research Institute. economic and social.

If the MPC raises interest rates too far before the effects on economic growth and inflation kick in, the risk is that MPC members will look like “fools in the shower”, Silvana Tenreyro said, outside member of the committee, who has always voted against rate hikes. . She warned that further monetary policy tightening could trigger a sharp decline.

But hawks fear the risk is that the MPC moves too slowly and fails to bring inflation back close to the BoE’s 2% target.

For most of the period since interest rates began to rise, financial markets have been a better guide than economists or BoE officials in predicting the likely rapid rise in the near term. interest rates.

Although the BoE is not expected to signal the need for further rate hikes, traders continue to bet on further tightening, with the futures market indicating that borrowing costs will end the year near 5%.

—————————————————-

Source link