“While service activities are currently in good shape, the positive impacts they have on the staffing industry are being partially offset by the contraction of economic activity in the manufacturing sector. However, companies like Manpower Group, Inc. (MAN), Heidrick & Struggles International, Inc. (HSII), and GEE Group, Inc. (WORK) are successfully navigating through these challenges with the help of remote work and increased use of technology.

The Zacks Staffing industry is a diverse sector that offers a wide range of human resources and workforce solutions. These services cover various aspects of personnel management and include employment selection, recruitment services, retirement planning, payroll administration, and more. Some companies also provide specialized services such as staffing and risk consulting.

There are four key factors influencing the future of the staffing industry. First, demand for services remains stable over time, which is beneficial for industry players. Second, the increased adoption of remote work and hybrid models, driven by the COVID-19 pandemic, has pushed staffing agencies to prioritize flexible work arrangements. Third, the use of technology is becoming more prevalent in the industry, with recruitment methods like artificial intelligence and Big Data on the rise. Lastly, the current high unemployment rate and contraction in the manufacturing sector pose concerns for future job growth.

The Zacks Industry Rank for the Staffing Firms industry is currently #202, indicating a disappointing future outlook. However, it’s important to note that the top 50% of Zacks-ranked industries tend to outperform the bottom 50%.

In terms of stock market performance, the staffing industry has lagged behind the broader business services sector and the S&P 500 composite over the past year.

Based on EV-EBITDA, which is commonly used to value personnel stocks, the industry currently trades at 5.87 times compared to the S&P 500 at 12.75X and the sector at 24.2X.

Three stocks to pay close attention to are GEE Group Inc., Heidrick & Struggles International Inc., and Manpower Group. GEE Group has shown solid financial performance and growth in IT contract services. Heidrick & Struggles is a renowned global executive search and leadership consulting firm, while Manpower Group is a global workforce solutions provider. All three stocks have positive outlooks and favorable earnings estimates.

Overall, while the staffing industry is facing challenges from the contraction in the manufacturing sector, companies that can adapt to remote work and leverage technology have a better chance of navigating through these difficult times.”

—————————————————-

| Article | Link |

|---|---|

| UK Artful Impressions | Premiere Etsy Store |

| Sponsored Content | View |

| 90’s Rock Band Review | View |

| Ted Lasso’s MacBook Guide | View |

| Nature’s Secret to More Energy | View |

| Ancient Recipe for Weight Loss | View |

| MacBook Air i3 vs i5 | View |

| You Need a VPN in 2023 – Liberty Shield | View |

While service activities are currently in good shape, their positive impacts on the staffing industry are being partially offset by the contraction of economic activity in the manufacturing sector.

Successful remote work and increased use of technology are helping Manpower Group, Inc. MAN, Heidrick & Struggles International, Inc. HSII and GEE Group, Inc. WORK to navigate through challenges.

Industry Overview

The Zacks Staffing industry is a diverse sector that encompasses companies that offer a wide range of human resources and workforce solutions. These services cover various aspects of personnel management, including employment selection, recruitment services for temporary and long-term job placements, retirement planning, human capital management, payroll administration, performance evaluation, organizational planning and Financial management. Additionally, some companies within this industry provide specialized services, such as staffing and risk consulting, professional staffing, and global business solutions tailored to the needs of small and medium-sized businesses. They also offer organizational consulting services with global reach, serving a wide and varied client base, which includes national and international companies from different countries.

4 factors influencing the future of the staffing industry

Stable demand: The industry is mature and demand for services remains stable over time. Revenue, income and cash flows are expected to gradually reach pre-pandemic levels, which will help most industry players pay stable dividends.

Increased adoption of remote work and hybrid models: The COVID-19 pandemic fueled a rapid increase in the adoption of remote work, leading staffing agencies to emphasize remote and hybrid staffing solutions. These flexible work arrangements meet the needs of clients and job seekers seeking greater work-life balance. As the trend toward remote work persists, staffing agencies are expected to prioritize this approach, allowing them to effectively meet changing workplace preferences.

The use of technology is gaining ground in staffing: The staffing industry has been increasingly leveraging technology to streamline processes, improve efficiency, and provide better services. The use of technology-driven recruitment methods such as artificial intelligence, social media and Big Data is on the rise. Video conferencing tools such as Zoom and Microsoft Teams facilitate remote communication, while cloud and blockchain improve the security of HR data, ensuring sustained demand for staffing services.

Currently high unemployment rate: In August 2023, there was a notable increase in the unemployment rate, which rose by 0.3 percentage points to 3.8%. This resulted in 514,000 more people classified as unemployed, bringing the total to 6.4 million. Additionally, the Conference Board’s Employment Trends Index, a key composite indicator for employment, declined from a revised 114.71 in July to 113.02 in August. Adding to these concerns, the manufacturing sector continued to contract for the tenth consecutive month in August, following a 28-month period of growth, as supply executives reported in the latest ISM Manufacturing Business Report. Additionally, a decline in gross domestic product (GDP) growth is a cause for concern. Real GDP for the second quarter of 2023 increased at an annual rate of 2.1%, according to the “third” estimate. In the previous quarter, real GDP had increased by 2.2% (revised). In light of these economic indicators, the employment trend suggests that, while employment growth may persist in the coming months, the pace of growth is expected to slow, which could lead to job losses in the future.

Zacks Industry Rank Indicates Disappointing Future

The Zacks Staffing Firms industry, which falls within the broader Zacks Business Services sector, is currently ranked #202 in the Zacks Industry Rank. This rank puts it in the bottom 17% of over 240 Zacks industries.

The group’s Zacks Industry Rank, which is essentially the average of the Zacks Rank of all member stocks, indicates continued near-term outperformance. Our research shows that the top 50% of Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one.

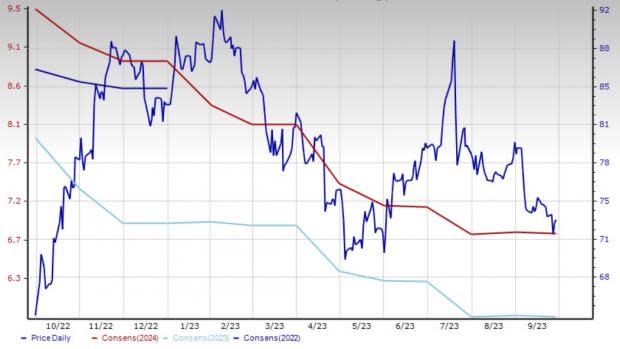

Analysts covering companies in this industry have been reducing their estimates. Over the past year, the consensus industry earnings estimate for the current year decreased 29.6%.

Before introducing some stocks you may want to consider for your portfolio, let’s take a look at the industry’s recent stock market performance and its current valuation.

Industry price performance

The Zacks Staffing Firms industry has lagged the broader Zacks Business Services sector and the Zacks S&P 500 composite over the past year.

The industry has lost 0.3% over this period compared with a 10.1% gain for the broader sector and a 17.7% gain for the Zacks S&P 500 Composite.

One-year price performance

Current industry assessment

Based on EV-EBITDA (enterprise value to earnings before interest, taxes, depreciation and amortization), which is commonly used to value personnel stocks due to their high debt levels, the industry currently trades at 5.87 times compared to the S&P 500 12.75X and the sector 24.2X.

Over the past five years, the industry has traded as high as 13.27X, as low as 3.63X, and at the median of 7.06X, as the charts below show.

EV to EBITDA

3 Staffing Actions to Pay Close Attention to

We present three stocks that are well positioned for growth in the short term.

Gee Group INC.: This Zacks Rank #1 (Strong Buy) company is a US-based human resources and staffing solutions company serving various industries such as IT, engineering, finance, manufacturing, and healthcare. They provide temporary and permanent staff, along with consulting and workforce management services. Gee Group’s primary focus is matching qualified candidates with job openings while helping businesses address their staffing needs. You can see The complete list of today’s Zacks #1 Rank stocks here.

The GEE Group’s solid financial performance, eight quarters of profitability and a solid liquidity position, without debt and with ample resources, reflect its resilience. The significant growth in IT contract services stands out, representing 59% of professional income. Despite economic challenges, the company maintains a positive outlook, focusing on profitability and enhancing shareholder value.

For 2023, the Zacks Consensus Estimate for JOB’s earnings is pegged at 10 cents, up 42.9% from the prior-year figure. The final result estimate for 2023 was revised north by 100% in the last 60 days. The company has a VGM Score of A, which makes for an attractive stock pick when combined with the rating.

Price and consensus: WORK

Heidrick and International Fights: This Zacks Rank #1 company is a renowned global executive search and leadership consulting firm based in the United States. He specializes in identifying senior executive talent for organizations, including CEOs and board members. The company also offers leadership consulting services to help clients improve their leadership teams. With a strong reputation in executive search and leadership consulting, Heidrick & Struggles significantly contributes to shaping the dynamics of corporate leadership around the world.

For the third quarter of 2023, HSII expects revenue between $245 million and $265 million, considering typical seasonal patterns. Stronger relative performance is expected from On-Demand Talent and Heidrick Consulting, offsetting a slowdown in Executive Search.

For 2023, the Zacks Consensus Estimate for HSII is pegged at $2.77, revised north by 3.4% over the past 60 days. The company beat earnings estimates over the trailing four quarters with an average beat of 18.8%. The company currently has a Value Score of B.

Price and consensus: HSII

Manpower Group: This Zacks Rank of 2 (Buy) company is a US-based global workforce solutions provider offering staffing, talent acquisition, management and consulting services. They connect job seekers with opportunities and help organizations find the right talent. With operations in more than 80 countries, the company is a major player in human resources and staffing, promoting workforce development and providing information on labor market trends to businesses and policymakers.

ManpowerGroup’s cautious outlook for the third quarter of 2023 anticipates challenges, especially in the United States and Europe, with further weakening in permanent hiring. Earnings per share are expected to be in the range of $1.32-$1.42, with a positive impact of 8 cents per share in foreign currency. Revenue, in constant currency, is expected to decline between 3% and 7%. The EBITDA margin is projected to decrease 120 basis points and the effective tax rate is estimated to be 30%. The outlook reflects awareness of current economic challenges and opportunities.

For 2023, the Zacks Consensus Estimate for MAN is pegged at $5.78, unchanged over the past 60 days. The company has a history of earnings surprises, with an average negative surprise of 1%. The company currently has a Value Score of B.

Price and consensus: MAN

Want the latest recommendations from Zacks Investment Research? Today you can download the 7 best stocks for the next 30 days. Click to get this free report

ManpowerGroup Inc. (MAN): Free Stock Analysis Report

Heidrick & Struggles International, Inc. (HSII): Free Stock Analysis Report

GEE Group Inc. (JOB): Free Stock Analysis Report

—————————————————-