Featured Sponsor

| Store | Link | Sample Product |

|---|---|---|

| UK Artful Impressions | Premiere Etsy Store |

This article is an on-site version of ours FirstFT news bulletin. Subscribe to our Asia, Europe/Africa OR Americas edition to receive it directly in your inbox every weekday morning

Most large US companies are take refuge in bankruptcy courta sign of a tightening credit crunch as interest rates rise and financial markets become less hospitable to borrowers.

Eight companies with more than $500 million in liabilities filed for Chapter 11 bankruptcy this month, including five in a single 24-hour period last week. In 2022, the monthly average was just over three deposits.

Twenty-seven large debtors have filed for bankruptcy so far in 2023 compared to 40 in all of 2022, according to data compiled by bankruptcydata.com. Recent companies succumbing to creditors include Envision Healthcare, Vice Media and Kidde-Fenwal, a fire systems maker facing thousands of lawsuits over the use of so-called forever chemicals.

S&P Global expects the trailing 12-month default rate for speculative securities to drop from the current 2.5% to 4.5% by early 2024.

Here’s what else is happening in the next few days:

-

US debt ceiling: The negotiators hope to finalize an agreement to avoid a default ahead of the looming June 1 deadline, when the country could run out of cash to pay its financial obligations.

-

Economic data: France releases consumer confidence data today, while the UK releases retail sales data for the past month and the University of Michigan releases its consumer confidence survey for the US.

-

Cannes: The film festival ends on Saturday in the south of France. Read the reviews of Raphael Abraham.

-

Elections: Voters travel to the polls on Sunday for the runoff in Turkey’s presidential election, the second round of municipal elections in Italy, and regional and municipal elections in Spain.

Five more top stories

1. UK ministers considering reshaping £39bn pension protection fund to boost business investment. The fund currently has a limited role in providing a safety net for pension schemes when their employer goes bankrupt and cannot fully meet members’ pension payment promises. Read the full story.

2. Exclusive: Norway’s $1.4 trillion oil fund will side with climate activists against ExxonMobil and Chevron at company annual meetings next week in a bid to force US majors to introduce targets for reducing emissions from the use of its products. Read more from the FT’s interview with the world’s largest sovereign wealth fund.

3. UK’s failure to create post-Brexit rules for chemicals sector risks ‘irreparable damage’ to British businesses, the industry has warned, after 18 months of talks with the government have yielded no fruit. Senior industry figures lament their concerns they have not been addressed.

4. Exclusive: The UK’s Financial Conduct Authority is surveying the green loan market interviewing bankers and borrowers, and may introduce a voluntary code of conduct to establish best practice for loan design. That’s why the regulator is pushing for transparency.

5. JPMorgan Chase is cutting about 1,000 First Republic employees, or about 15 percent of the California-based bank’s 7,000 workers across its operations, people familiar with the matter said. Read more about JPMorgan’s move after its hasty takeover.

How well did you manage to keep up with the news this week? Take our quiz.

In-depth news

© FT Montage/Bloomberg/Alamy/Getty Images

An analysis by the Financial Times has given further proof of what many in the City already fear: London is the European stock exchange most at risk of undergoing large outflows towards the USA. Of the 111 European companies assessed, London listings make up half of the top 10. See the full list here.

We are also reading. . .

Chart of the day

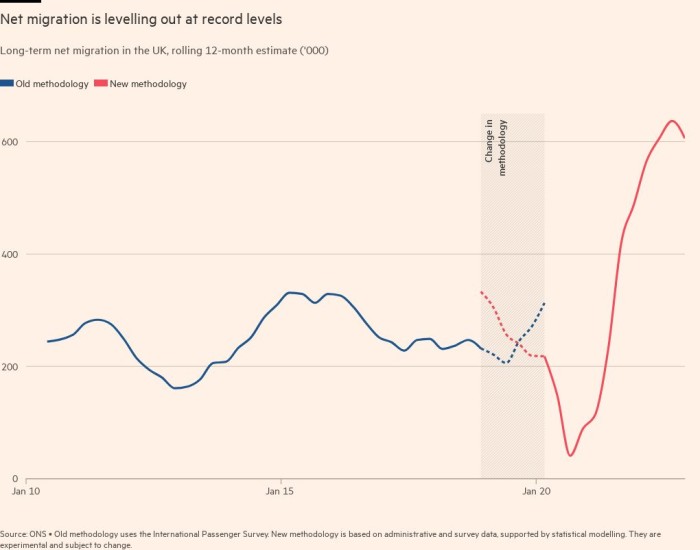

Official immigration data yesterday showed net long-term arrivals into the UK it reached an all-time high of 606,000 last year, reflecting several coincident factors: the opening of humanitarian routes for people from Ukraine and Hong Kong, a post-Covid surge in cross-border hiring, and a government push to attract foreign students.

Take a break from the news

Every meal tastes better when it’s seasoned with the sun: A peach will somehow taste more peachy, peas are bright and lively, a tomato more grassy and robust. Don’t miss this perfect menu for an outdoor meal.

Additional contributions by Gordon Smith and Emily Goldberg

—————————————————-

Source link

We’re happy to share our sponsored content because that’s how we monetize our site!

| Article | Link |

|---|---|

| UK Artful Impressions | Premiere Etsy Store |

| Sponsored Content | View |

| ASUS Vivobook Review | View |

| Ted Lasso’s MacBook Guide | View |

| Alpilean Energy Boost | View |

| Japanese Weight Loss | View |

| MacBook Air i3 vs i5 | View |

| Liberty Shield | View |