Good morning. This article is an on-site version of ours FirstFT news bulletin. Subscribe to our Asia, Europe/Africa OR Americas edition to receive it directly in your inbox every weekday morning

The most significant stress since the 2008 financial crisis hasn’t dampened US bank profits, which are up 33% from a year ago to reach an all-time high of about $80 billion in the first quarter.

The uproar was largely responsible for fender recovery. About half of the increase in aggregate industry profits came from one-time earnings posted by First Citizens and Flagstar, which bought the remnants of Silicon Valley Bank and Signature Bank, respectively, after they were seized by regulators and sold off with a discount in March.

Even so, the jump in profits also showed that US banks in general benefited from rising interest rates, low loan delinquencies and an expanding job market despite jitters among depositors and investors.

Of the nation’s nearly 4,400 banks, only 197 — or less than 5 percent — suffered losses in the first quarter, according to BankRegData, which compiles quarterly reports made by lenders to the Federal Deposit Insurance Corporation.

Here are two opinion articles that I recommend on what comes next for banking.

-

Prevent turmoil: Although conditions have stabilised, more needs to be done halt a third round of bank shockswrites Mohamed El-Erian.

-

Congress must act: The US must reinstate measures that protected operational corporate accounts during the pandemic to protect smaller bankswrites Sheila Bair, former president of the US Federal Deposit Insurance Corporation.

And here’s what else I’m keeping an eye out for today:

-

NATO meeting: Defense chiefs meet in Brussels to discuss Russia’s war in Ukraine.

-

Google: The tech giant is holding its annual I/O conference in California, where CEO Sundar Pichai is expected to speak.

-

Results: ABN Amro, Ahold Delhaize, Alstom, Asos, Compass Group, Continental AG, Crédit Agricole, Disney, Eon, Ferroglobe, The New York Times Company and Tui report.

-

Economic data: The US and Germany have consumer price indices for the past month, while KPMG and REC release their employment report for the UK.

Five more top stories

1. Exclusive: Uber launched flight bookings in its UK app, allowing customers to book a complete journey across multiple forms of transportation. Read more about the ride-booking giant’s drive to become a travel “super app.”.

2. US President Joe Biden urged Republicans to ‘take the threat of default off the table’ after his first major meeting with congressional leaders on the debt ceiling he failed to achieve a breakthrough. Party leaders are expected to meet Biden again on Friday. Here’s what could happen if the US defaults on its debt.

3. COP28 hired a former Boris Johnson aide who opposed a tax on oil and gas companies. The decision to hire right-wing strategist David Canzini, who assisted the British prime minister in his final months in office, has raised concern among environmentalists.

4. A Saudi Arabian state-backed group is trying to launch an English-language news channel which could compete with Qatar’s Al Jazeera. Read more about the kingdom’s plans to expand its global media influence.

5. Donald Trump was found responsible for the sexual abuse of a journalist in a Manhattan department store in the 1990s, in a significant legal defeat for the former US president as he mounts a third bid for the White House. The judging panel awarded plaintiff E Jean Carroll, a former pundit and television presenter, a total of $5 million in damages.

The big read

© Karen Dias/FT

Russia’s rough diamond exports were worth $4 billion in 2021, just a fraction of its crude oil exports. But every source of disposable income matters to Moscow’s treasury as it finances its invasion of Ukraine. G7 officials should do it this month target the sale of Russian diamonds in their own countries in an effort to squeeze Moscow’s access to funding and — they hope — hamper the Kremlin’s ability to wage war.

We are also reading. . .

-

Executive salary: With CEOs in the US earning a median of $13.4m compared to $5.5m in the UK, pay for UK executives pass through the pond?

-

Warfare Technology: The invasion of Ukraine has accelerated the disruption of innovative military technologies such as sensors, robotics and unmanned systems.

-

Sudan and China: African nation’s conflict has dealt a major blow to Beijing’s lending strategy with the continent, putting it at further risk loans of at least $5 billion.

Chart of the day

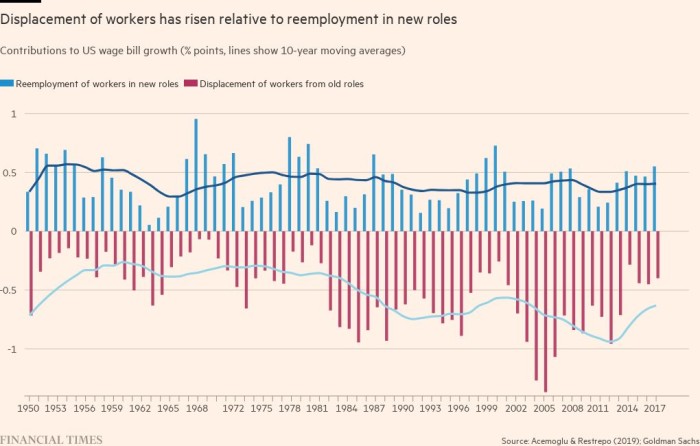

In 1900, the United Kingdom had 3.3 million horses to provide draft, transport and cavalry power. Now, I’m an outdated technology. With the rise of artificial intelligence, Martin Wolf asks if the same fate awaits humans.

Take a break from the news

In the central African rainforest, forest elephants emerge from the jungle to congregate in greater numbers than anywhere else on earth. Don’t miss Financial Times Africa editor David Pilling’s reflection on a unique trip to Sangha Lodgea jungle sanctuary.

Additional contributions by Gordon Smith and Emily Goldberg

Thanks for reading and remember you can add FirstFT to myFT. You can also choose to receive a FirstFT push notification every morning in the app. Send your advice and feedback to firstft@ft.com

—————————————————-

Source link