Title: Japan Seeks to Attract Global Investors with Promising Economic Outlook

Introduction:

Japan’s Prime Minister, Fumio Kishida, has embarked on a charm offensive to attract international investors, appealing to BlackRock founder Larry Fink and other global financial leaders to invest in Japan’s future. As part of the government’s “Japan Weeks” campaign, Kishida hosted some of the largest sovereign wealth funds and emphasized the country’s strong economy and wages, along with its near record-high stock prices. In addition, he highlighted Japan’s potential to unlock $14 trillion in household savings through wealth management industry reform and tax-free investment vehicles.

Capitalizing on Japan’s Economic Transformation:

Kishida expressed his confidence in Japan’s transformation into an international financial center and assured investors of the government’s commitment to implementing further reforms. The aim is to facilitate foreign investment, bring flexibility to the workforce, and increase mobility. The Japanese government seeks to address the challenges posed by a rapidly shrinking workforce and reduce reliance on external factors that have buoyed the economy thus far.

Investor Optimism and Lingering Concerns:

The prime minister’s speech, attended by investment giants such as BlackRock, KKR, and Blackstone, generated a sense of optimism among attendees. However, veteran Japan investors caution that sustaining global interest in the country will require continued positive developments and faith in long-term stability.

While external factors like global inflation and geopolitical uncertainties have benefited Japan, a lasting transformation must be rooted in domestic developments. Japanese authorities are aware that this might be their “last chance” to attract significant global investment. Although the government intervened to support currency, stock, and bond markets, demonstrating underlying challenges, there is a growing need for sustainable growth.

The Importance of Financial Allocations and Foreign Investments:

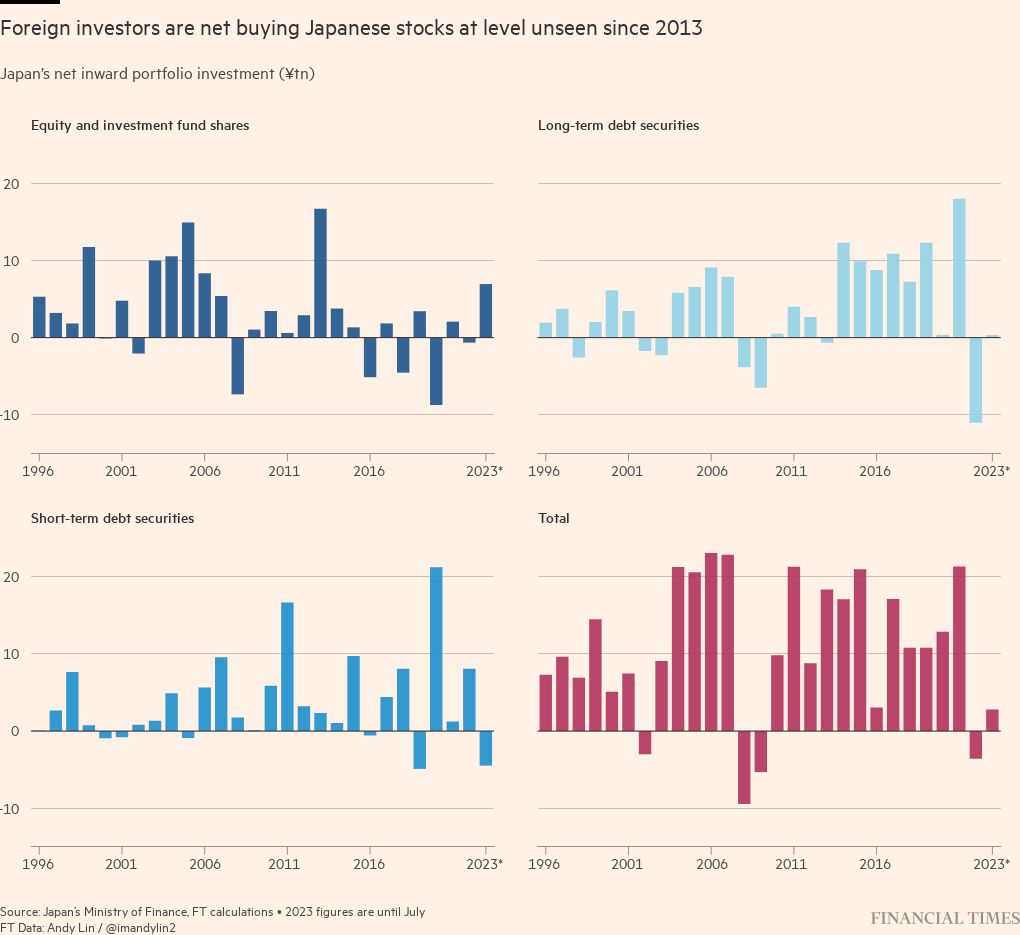

Japanese life insurers and pension funds are considering reducing their exposure to domestic stocks, citing a strong home country bias. To combat this, Kishida’s government aims to attract non-resident investors through targeted moves such as reducing foreign barriers and increasing foreign stock portfolios. However, the shift will require time, especially for international fund managers who have been historically hesitant due to Japan’s weak performance.

Nomura, the Japanese investment bank, estimates that eliminating non-resident investors’ underweight position could significantly raise the Nikkei 225 index. But even before investors turn fully bullish, the factors that attracted global interest to Japanese stocks are starting to weaken. The closing interest rate gap between Japan and the United States could strengthen the yen, making Japan less attractive to foreign investors.

Kishida’s Vision for the Future:

While Kishida promotes Japan’s attractiveness to international investors, he also focuses on internal dynamics and the country’s transition from cost cuts to investment in human capital. Addressing Japan’s largest trade union, he expressed optimism that the economy could enter a new “Goldilocks phase” for the first time in three decades, emphasizing the importance of seizing this opportunity.

Conclusion:

Japan’s prime minister, Fumio Kishida, is actively seeking global investment in the country’s future by showcasing Japan’s strong economy, high stock prices, and its potential to unlock significant household savings. While the speech resonated with top investors, there is an understanding that the government needs to sustain these positive developments to attract long-term investments. The shift to foreign investments and the reduction of domestic biases within financial allocations are crucial aspects of Japan’s strategy. As external factors weaken, Japan must generate internal growth and address challenges to maintain global interest. Kishida’s vision for the future involves transitioning from cost cuts to investment in human capital, signaling a transformational shift in Japan’s economic landscape.

—————————————————-

| Article | Link |

|---|---|

| UK Artful Impressions | Premiere Etsy Store |

| Sponsored Content | View |

| 90’s Rock Band Review | View |

| Ted Lasso’s MacBook Guide | View |

| Nature’s Secret to More Energy | View |

| Ancient Recipe for Weight Loss | View |

| MacBook Air i3 vs i5 | View |

| You Need a VPN in 2023 – Liberty Shield | View |

Japanese Prime Minister Fumio Kishida appealed to BlackRock founder Larry Fink and others who control $18 trillion in assets to invest in Japan’s future, capping a charm offensive to attract capital to the country.

Some of the largest sovereign wealth funds were hosted by Kishida during the government’s “Japan Weeks” campaign, with the message that global investors should finally become bullish on the world’s third largest economy.

Kishida stressed that the economy and wages are stronger after decades of flirting with deflation and stagnant growth, while Japan stock prices are near a 33-year high.

He also said it Japan is poised to realize a 20-year “savings to investment” slogan, with a shake-up of the wealth management industry and an expansion of tax-free investment vehicles to unlock $14 trillion in household savings.

“I am convinced that people both inside and outside the country have sensed Japan’s willingness to transform itself to become an international financial center,” Kishida said Friday at a meeting with the world’s top investors.

“We will not hesitate to implement further reforms to pave the way towards a new Japan,” he added. “We ask you to invest again in Japan’s future.”

A decade after former Prime Minister Shinzo Abe’s “Abenomics” program, which included large asset purchases by the Bank of Japan and corporate governance reform, the Kishida administration is trying to implement what officials call “the last piece of the puzzle”. facilitating foreign investment and bringing greater flexibility and mobility to a rapidly shrinking workforce.

“As time goes on, we will continue to see these constructive policies take hold,” said Drew Edwards, a veteran Japanese portfolio manager who runs GMO’s Usonian equity funds, and who was visiting Tokyo this week. “I have been studying this market since the 1980s and without a doubt there are really good things happening.”

With top managers from BlackRock, KKR, Blackstone and sovereign wealth funds such as GIC and Norges Bank and state investor Temasek gathered to hear the prime minister’s speech, the sense of optimism is widespread.

But veteran Japan investors have warned that Kishida’s team has little time to sustain global interest in the country, which has benefited from external factors such as global inflation – which has finally helped pull Japan out of deflation – so such as the large gap between interest rates in Japan and the United States and geopolitical uncertainty over China.

“Japan seems like a hot spot for investment right now, partly because of China and partly because of what’s changing in a lot of companies. But people need to have faith that this will happen in the long term,” said the CEO of a large Japanese company.

“Investors here this week are not here to trade Japan – they are looking to see if these positive things they see now will still be in place in three, five, even 10 years.”

Demonstrating the underlying challenges for investors, the Japanese government had to intervene with messages and money to support the currency, stock and bond markets, even as Kishida carried out his promotional activities.

Wednesday, the The BoJ bought almost 13 billion dollars of public debt while yields on benchmark bonds reached their highest level in the last decade. On the same day, the central bank also bought 70.1 billion yen ($472 million) of exchange-traded funds, entering the market for the first time since March after the Topix fell 2.5%.

THE yenmeanwhile, it bounced higher after crossing the closely watched threshold of 150 yen against the dollar level, prompting brief speculation that Japanese authorities may have acted after weeks of verbal warnings.

Privately, senior government officials admit that this may be Japan’s “last chance” to lead a significant reallocation of global money into the Japanese market.

Masatoshi Kikuchi, chief equity strategist at Mizuho Securities, said Japanese life insurers and pension funds actually planned to reduce exposure to domestic stocks. “Because life insurers believe their stock portfolios have a strong home country bias, they are increasing foreign stocks,” he added.

According to Edwards, most international active fund managers are still “materially underweight” Japanese stocks after years of weak performance. “You have to experiment [the change] yourself – especially those who had bad experiences 20 years ago – and that takes a little bit of time,” he said.

Nomura, the Japanese investment bank, estimated that if non-resident investors completely eliminated their underweight position, it would send the Nikkei 225 index – which stands at around 31,000 points today – up by 4,900 points.

Even before investors turn fully bullish, several factors driving global interest in Japanese stocks are starting to weaken, said London-based Eddie Cheng of U.S. asset manager Allspring Global Investments.

Central banks in the United States and Europe are nearing the end of their rate-hiking cycle, meaning the yen could start to strengthen starting next year if the interest rate gap between Japan and the United States closes. will reduce. This would make Japan seem like less of a bargain to foreign investors.

“In the medium term we will be much more cautious,” said Cheng, who maintains an overweight position on Japan.

“We will see how much these external factors begin to reduce and how much actual growth Japan can generate to support the stock market. If Japanese companies are doing nothing, they take advantage of this time period. . . and relying solely on external factors, I think it will be very difficult” to sustain global interest, she added.

While promoting Japan’s attraction to foreign investors, Kishida also conveyed the message of transition to his country. Speaking to Japan’s largest trade union on Thursday, he stressed that the economy is on the verge of transitioning from decades of cost cuts to investment in human capital.

“We have a chance that the economy will move into a new Goldilocks phase for the first time in 30 years,” Kishida said. “We must not miss this opportunity.”

—————————————————-