Investors are increasingly nervous about a steep decline in risky corporate bond prices as credit conditions for US businesses and households become increasingly tight.

The US Federal Reserve’s Quarterly Opinion Survey of Senior Lending Officers this week showed that 46% of US banks intend to raise their lending standards due to concerns about loan losses and deposit flight.

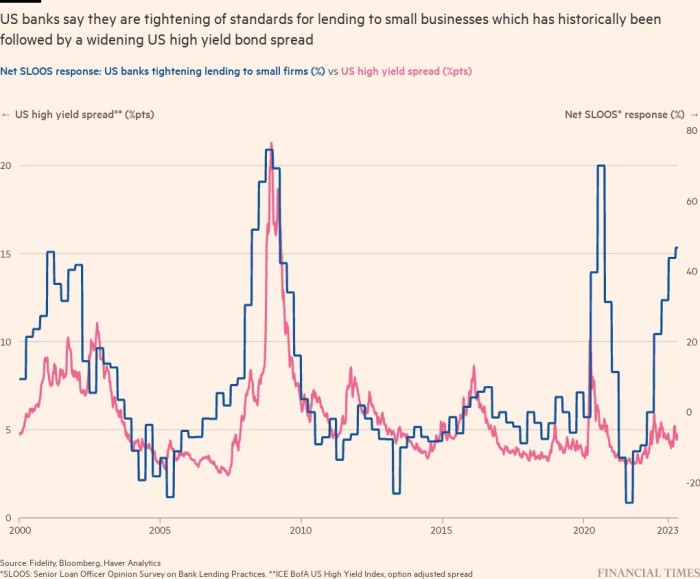

In the past, tighter lending standards have led to a widening of the spread, or gap, between the yields of riskier corporate bonds and ultra-safe government bonds, as credit becomes riskier to own.

But while lending hasn’t faded as feared after the Silicon Valley Bank collapse in March, the spread between high-yield bonds and Treasuries has remained relatively tight, leaving investors speculating that a correction is on the way.

“As for why corporate bond spreads haven’t budged yet, I think it’s simply because lending standards are a leading indicator of the real economy,” said Mike Riddell, bond fund manager at Allianz Global Investors.

“We think global risk premia will increase sharply once exceptionally tight lending standards start to have a major impact on global growth, which is expected to happen shortly.”

Ultimately, he said, it takes at least a year for a change in interest rates to have its full impact on the economy. The Fed started raising rates in March of last year.

Investor fears about the health of the US banking system are still rippling through the markets, more than two months after the SVB bankruptcy. PacWest shares have lost more than a fifth in value this week after the bank announced it lost nearly a tenth of its deposits in the first week of May. The KBW Regional Banks Index, which tracks midsize and local US banks, is down 35% year-to-date.

“The failures of several banks in recent months have been relatively well contained and a 2008-style crisis looks much less likely than when Silicon Valley Bank collapsed in March,” said Eugene Philalithis, head of multi-asset investments at Fidelity . “However, the US banking sector remains in a slow-motion slump.”

Fidelity believes that US high-yield bonds appear particularly vulnerable to tighter lending. Spreads are at levels consistent with a “more favorable outlook than reality suggests,” according to Philalithis, who is buying highly rated sovereign bonds and avoiding risky credits.

Howard Cunningham, a fixed-income portfolio manager at Newton Investment Management, said he also “sharply trimmed” exposure to high-yield bonds because “where lending standards go downhill, junk bond yields will follow.”

In its financial stability report earlier this week, the Fed cited the possibility of a credit crunch among the top current risks to the financial system, but not the Fed’s most likely scenario.

—————————————————-

Source link