The Impact of Declining Chinese Trade on the Global Economy

Introduction

Chinese exports have experienced a significant decline amidst the ongoing global pandemic, raising concerns about the growth trajectory of the world’s second-largest economy. According to official data released on Thursday, June exports fell by a staggering 12.4% year on year in dollar terms, marking the largest drop since February 2020. This decline surpassed expectations, as economists polled by Reuters had projected a more modest 9.5% decrease.

Alongside the decline in exports, imports also registered a decrease of 6.8%, outperforming expectations once again. In the previous month of May, exports and imports had fallen by 7.5% and 4.5% respectively. The downward trend in Chinese trade has been attributed to weaker international demand, further straining an already challenged economy.

Factors Affecting Chinese Trade

Weaker International Demand

Chinese exports have been hit hard by a decrease in international demand, which has coincided with existing economic challenges such as a struggling property sector and a disappointing post-Covid-19 rebound. As global economies continue to recover from the effects of the pandemic, consumer demand for Chinese goods has weakened significantly. This decline in demand abroad has led to a decline in production and a subsequent drop in Chinese exports.

The decline in international demand can be attributed to a variety of factors, including weakened consumer purchasing power, increased trade barriers, and changing consumption patterns. With countries grappling with their own domestic economic challenges, import demand for Chinese goods has diminished, contributing to the significant decline in Chinese trade.

Struggling Property Sector

In addition to weakened international demand, China’s economy has been further strained by a struggling property sector. The property market, which has been a key driver of Chinese economic growth, has faced multiple challenges in recent times. The government’s efforts to control property speculation and prevent a property bubble have resulted in slowing growth in the sector.

Furthermore, the Covid-19 pandemic disrupted the real estate market, leading to a decreased demand for housing and a decline in property investments. This downturn in the property sector has had a ripple effect on other sectors of the economy, including trade. The decline in investments and construction activities has resulted in reduced demand for construction materials, further impacting China’s export industry.

Challenges in Rebound After Covid-19 Controls

China’s trade sector has also been hampered by the challenges faced in the country’s post-Covid-19 rebound. Despite lifting many restrictions earlier this year, China has struggled to achieve a robust economic recovery. Numerous factors, including subdued consumer demand, the resurgence of Covid-19 cases in some regions, and supply chain disruptions, have hindered the country’s efforts to bounce back.

Government interventions and stimulus measures have been employed to support economic recovery, but the effectiveness of these measures remains uncertain. The ability of China’s domestic demand to rebound without significant government stimulus is a key question for the coming months. Achieving sustained economic growth will heavily depend on the revival of domestic consumption, which may require further policy interventions.

The Implications of Declining Chinese Trade

Impact on the Global Economy

The severe decline in Chinese trade has significant implications for the global economy. As one of the world’s leading exporters, China plays a crucial role in global supply chains. The reduced production and export levels from China have disrupted supply chains globally, affecting industries and businesses across various sectors.

The decline in Chinese exports has also contributed to concerns about the overall health of the global economy. China’s economy acts as a barometer for global economic activity, and the current decline in trade suggests a broader slowdown in global growth. As China grapples with its own economic challenges, its ability to stimulate global demand through exports is limited, potentially stifling global economic recovery.

Domestic Economic Challenges

The decline in Chinese trade not only has global implications but also poses significant challenges for China’s domestic economy. Weakened trade activities have led to job losses and increased unemployment rates in certain sectors. One notable consequence is the surge in youth unemployment, which has reached its highest point since China began reporting data in 2018.

Moreover, weak consumer demand and the risk of deflation have further exacerbated China’s domestic economic challenges. Consumer spending plays a vital role in driving economic growth, and weak demand has hindered the country’s recovery. Policymakers in China face the challenging task of reviving consumer confidence and stimulating domestic demand through carefully tailored policy measures.

Outlook for Chinese Trade and the Economy

Gross Domestic Product (GDP) Data and Growth Target

The release of Gross Domestic Product (GDP) data in the coming days will provide additional insights into the health of the Chinese economy. The Chinese government had set a growth target of 5% for the full year, the lowest level in decades, after achieving a modest growth rate of just 3% in 2022. Premier Li Qiang expressed optimism, stating that second-quarter performances would exceed those of the first quarter, aiming for a growth rate of 4.5 percent.

Policymakers’ Approach to Stimulus

Policymakers in China have taken a cautious approach to stimulus measures thus far. Instead of implementing large-scale stimulus packages, they have opted to loosen key interest rates to support growth. Additionally, policymakers have introduced measures to provide cautious support to the real estate sector, which accounts for a significant portion of economic activity. Balancing economic stability and financial risks remains a key priority for policymakers as they navigate the intricate challenges of stimulating growth.

Conclusion

The significant decline in Chinese trade has added to concerns about the growth trajectory of the world’s second-largest economy. Weakened international demand, a struggling property sector, and challenges in the post-Covid-19 rebound have all contributed to the decline. The implications of this decline reverberate globally, affecting supply chains and casting a shadow on the overall health of the global economy.

Looking ahead, the revival of domestic demand and the effectiveness of policy interventions will shape China’s economic recovery. Policymakers face the complex task of balancing economic stability and addressing domestic economic challenges while stimulating growth. The success of these efforts will be crucial to not only China’s own economic well-being but also to the broader global economic recovery and stability.

Summary

Chinese export and import activities have experienced a significant decline, surpassing expectations, amidst weaker international demand and various domestic economic challenges. The decline in Chinese trade has implications for the global economy, disrupting supply chains and raising concerns about global growth. Domestically, a struggling property sector and challenges in the post-Covid-19 rebound have further strained China’s economy. Policymakers are cautiously approaching stimulus measures, focusing on supporting growth through interest rate adjustments while addressing financial risks. The revival of domestic demand and sustained policy interventions will be key factors in China’s economic recovery and its impact on the global economic landscape.

—————————————————-

| Article | Link |

|---|---|

| UK Artful Impressions | Premiere Etsy Store |

| Sponsored Content | View |

| 90’s Rock Band Review | View |

| Ted Lasso’s MacBook Guide | View |

| Nature’s Secret to More Energy | View |

| Ancient Recipe for Weight Loss | View |

| MacBook Air i3 vs i5 | View |

| You Need a VPN in 2023 – Liberty Shield | View |

Receive Free Chinese Trade Updates

We will send you a myFT Daily Summary email summarizing the latest Chinese trade news every morning.

Chinese exports suffered their biggest year-on-year decline since the start of the coronavirus pandemic, adding to concerns about the growth trajectory of the world’s second-largest economy.

June exports fell 12.4% year on year in dollar terms, official data showed on Thursday, the biggest drop since February 2020. Economists polled by Reuters had expected a 9.5% decline.

Imports fell 6.8%, also beating expectations. In May, exports and imports fell by 7.5% and 4.5% respectively.

China’s exports this year have been hit by weaker international demand at a time when the economy is already strained by a struggling property sector and a disappointing rebound after Covid-19 controls were lifted earlier this year. ‘year.

Youth unemployment also hit its highest point since China began reporting data in 2018, while weak consumer demand has helped push the country down. on the verge of deflation.

“China must depend on domestic demand,” said Zhiwei Zhang, president of Pinpoint Asset Management. “The big question for the next few months is whether domestic demand can rebound without much government stimulus.”

The General Administration of Customs said on Thursday that trade growth faced “relatively significant pressure” and cited economic and geopolitical risks. He said yuan-denominated exports rose 3.7 percent in the first half of the year.

Gross domestic product data to be released on Monday will shed additional light on the health of the Chinese economy. The government has set an official growth target of 5% for the full year, its lowest level in decades, after posting growth of just 3% in 2022. Premier Li Qiang said last month that second quarter performances would exceed those of the first quarter. rate of 4.5 percent.

Policymakers in China have so far refrained from large-scale stimulus, instead loosening key interest rates last month to support growth. They also introduced cautious measures to support a real estate sector which accounts for more than a quarter of economic activity but which is struggling with a wave of defaults.

Inflation data this week showed the country was on the brink of consumer price deflation, implying continued weakness in domestic spending months after the anti-Covid regime was scrapped. Ex-factory prices are already in negative territory.

After an initial decline, Chinese exports surged at the start of the pandemic as consumption in other countries shifted towards goods and away from services. Official data often reflected double-digit percentage increases.

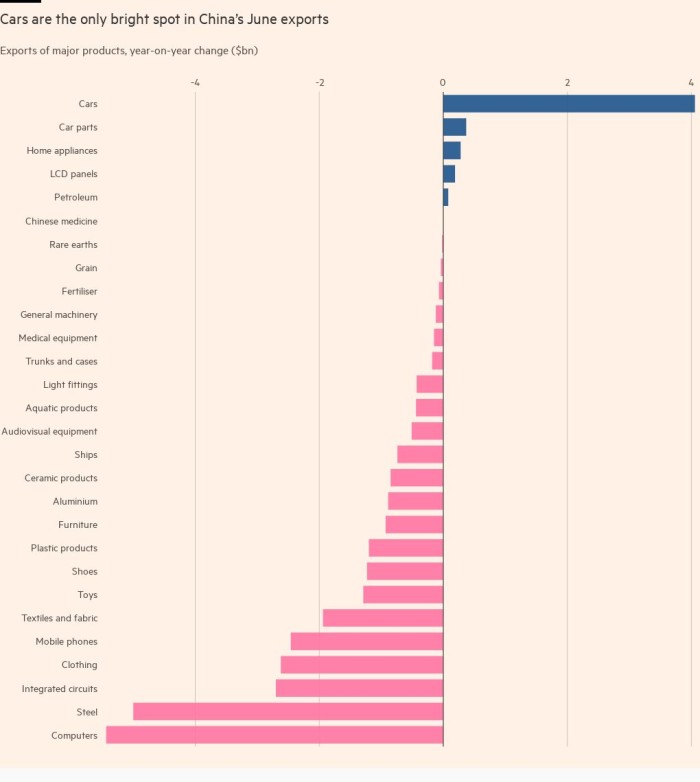

Thursday’s data showed a reversal, with broad-based declines across all categories, including cellphones, computers, steel and apparel exports.

One exception was car exports, which rose $4.1 billion from the same period last year.

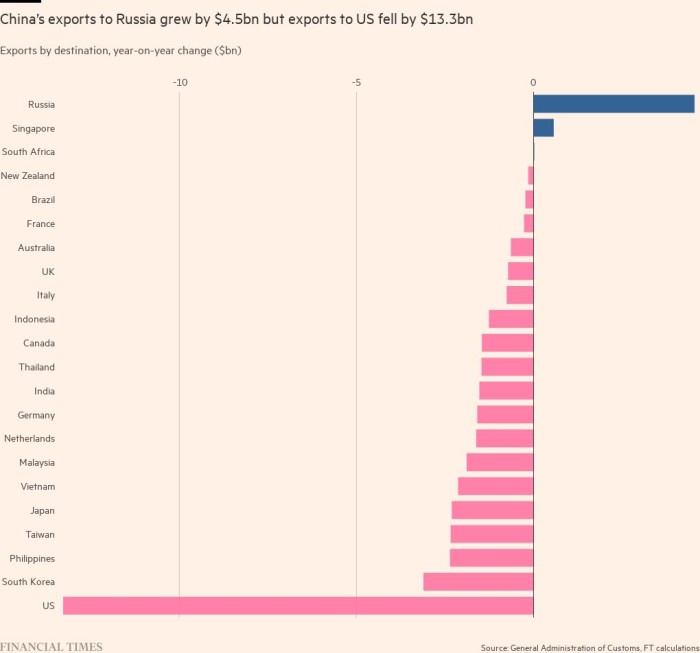

Exports to Russia and Singapore also increased in terms of dollar value, but goods to all other major economies declined.

—————————————————-