Additional Piece: Navigating Inflationary Pressures in a Changing Economic Landscape

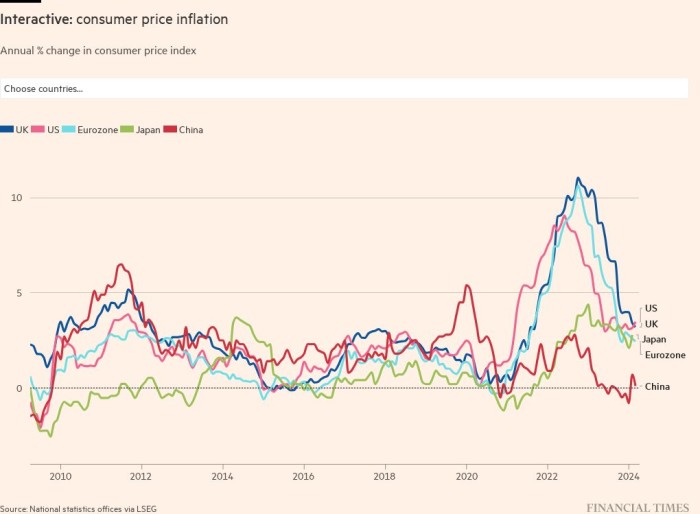

Inflation has become a pressing concern for many economies around the world, particularly in the aftermath of Russia’s full-scale invasion of Ukraine. While global inflation rates remain high, there are signs of slowing in some countries, offering a glimmer of hope for stability in the future.

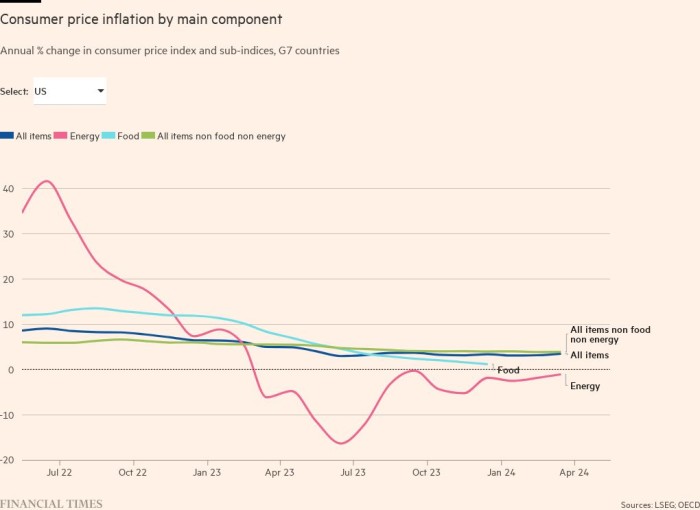

The impact of the war in Ukraine has been felt on multiple fronts, with energy and food prices soaring due to supply disruptions and geopolitical tensions. However, in certain countries, these pressures have started to ease, leading to a decrease in wholesale energy and food prices. This reduction in pricing pressures is a positive indication that inflation may stabilize in the coming years.

Central banks have responded to high inflation by implementing a series of interest rate hikes. While this move aims to mitigate inflationary pressures, it also poses a risk of exacerbating the already strained real incomes of individuals. Striking a balance between containing inflation and supporting economic growth is a delicate task for policymakers.

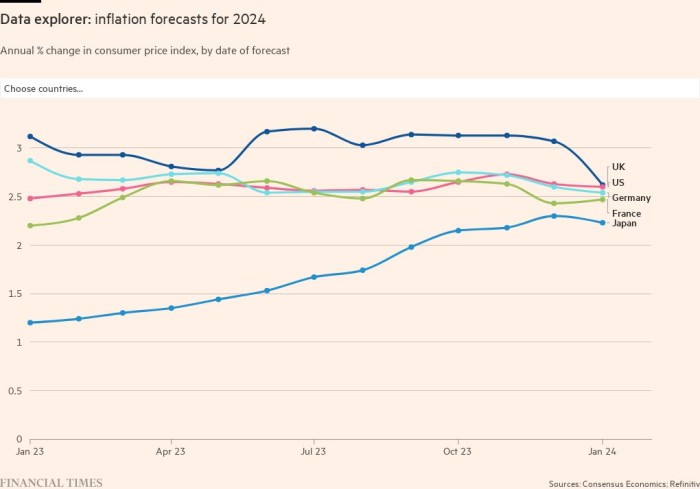

Economists’ expectations for the future still suggest elevated inflation levels in many countries, despite stabilizing trends observed elsewhere. Projections for 2023 indicate upward revisions for inflation in several nations, including Germany. These forecasts highlight the need for continued vigilance in monitoring and managing inflationary risks.

Investors’ expectations of future inflation levels have stopped rising, reflecting the more aggressive tightening measures by central banks and a weaker economic outlook. Governments in certain European countries have implemented fiscal measures to address the rising energy costs, which has had some impact on alleviating inflationary pressures.

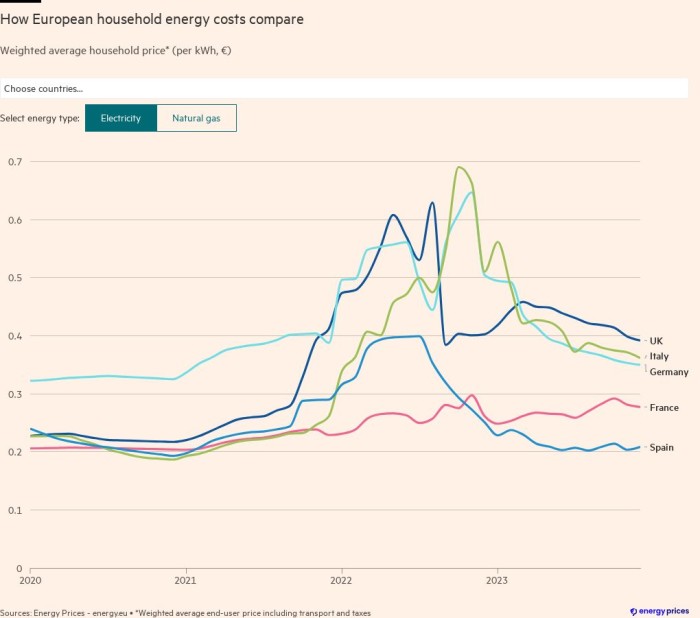

Rising energy prices have been a significant driver of inflation even before the Ukraine conflict. The conflict further intensified these pressures, leading to Europe seeking alternative gas supplies. However, the situation has started to improve as weakening global demand and increased capacity of European gas storage facilities have contributed to a decline in wholesale prices.

While wholesale price decreases might eventually translate into lower consumer prices, the pass-through is not immediate. Household and business costs remain high in Europe due to the lingering effects of the energy crisis. The higher costs of living pose challenges for the less affluent, limiting their ability to afford basic necessities such as food and shelter.

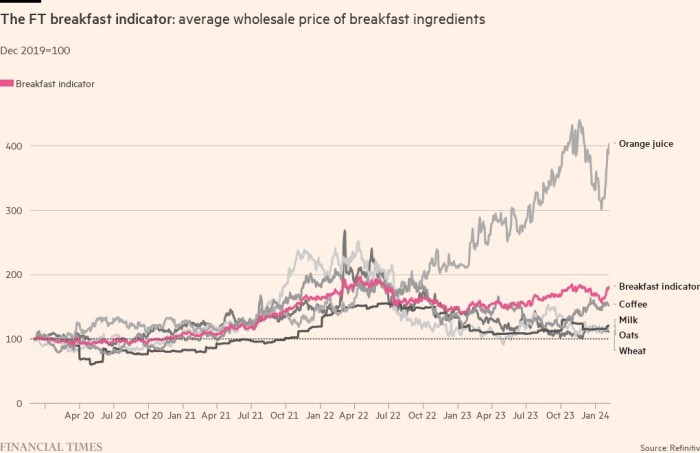

Food prices have also experienced a significant increase, affecting the most vulnerable consumers. Rising prices restrict households’ purchasing power and limit their ability to spend on goods and services. Developing countries are particularly affected, as the wholesale price of food has a more substantial impact on final food prices and constitutes a larger share of household expenditure.

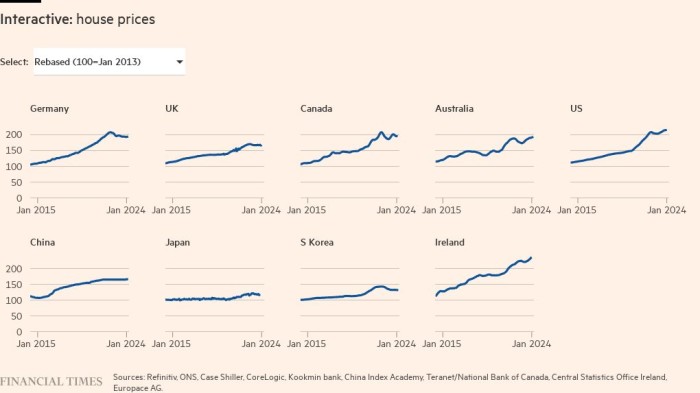

Another area of concern is the soaring prices of assets, particularly homes. The pandemic, along with loose monetary policies, increased demand for larger living spaces among remote workers and government support programs, causing a surge in house prices. However, rising mortgage rates have already begun to slow down the growth in housing prices.

In conclusion, inflationary pressures have been a significant challenge for economies across the globe, driven by multiple factors including geopolitical tensions, energy prices, and rising food costs. While there are signs of slowing inflation in some countries, sustained efforts are needed to stabilize prices and support economic growth without compromising real incomes. Governments, central banks, and policymakers must strike a delicate balance to navigate the changing economic landscape and ensure a sustainable and equitable recovery for all.

Summary:

Inflationary pressures have shown signs of slowing following Russia’s invasion of Ukraine, with certain countries experiencing eased pricing pressures in energy and food. However, high inflation remains geographically widespread, and inflation projections for 2023 have been revised upwards in many countries. Central banks have responded with interest rate hikes, potentially affecting real incomes. The pass-through from wholesale to consumer prices is not immediate, and high household and business costs persist. Rising food prices particularly impact the poorest consumers, limiting their ability to afford basic necessities. Asset prices, including housing, have soared but are now experiencing a slowdown in growth. Navigating inflation and ensuring economic stability require careful coordination and effective policy measures.

Keywords: inflation, pricing pressures, Russia’s invasion of Ukraine, energy prices, food prices, inflation projections, interest rate hikes, pass-through, wholesale prices, consumer prices, household costs, food expenditure, asset prices, housing market, economic stability.

—————————————————-

| Article | Link |

|---|---|

| UK Artful Impressions | Premiere Etsy Store |

| Sponsored Content | View |

| 90’s Rock Band Review | View |

| Ted Lasso’s MacBook Guide | View |

| Nature’s Secret to More Energy | View |

| Ancient Recipe for Weight Loss | View |

| MacBook Air i3 vs i5 | View |

| You Need a VPN in 2023 – Liberty Shield | View |

Inflation has started to show signs of slowing from decades-long highs reached in many countries following Russia’s full-scale invasion of Ukraine.

The latest figures for most of the world’s largest economies remain worrying, with pricing pressures remain high while the war in Ukraine continues to keep energy and food prices high. But in some countries the pressures have eased and wholesale energy and food prices have come down. Economists and investors also expect inflation levels to stabilize over the next few years.

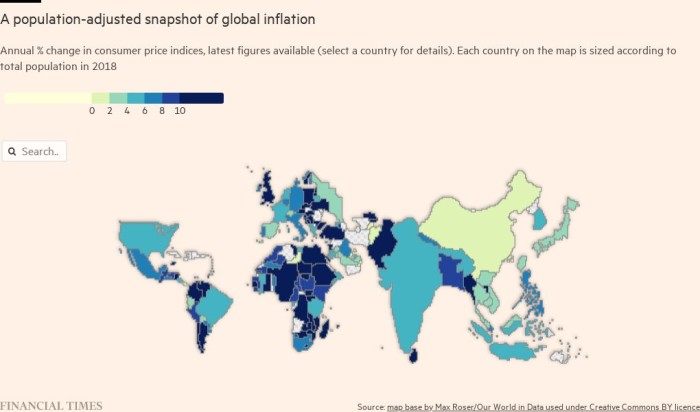

High inflation remains geographically widespread, although it is lower in many parts of Asia.

Central banks have responded with a series of interest rate hikes, although higher borrowing costs could exacerbate pressure on real incomes.

This page provides a regularly updated visual narrative of consumer price inflation around the world.

He understands economists’ expectations for the future, which still show that inflation projections for 2023 are revised upwards for many countries, even though they have stabilized elsewhere, including Germany, according to the main forecasters surveyed. by Consensus Economics.

Investors’ expectations of where inflation will look five years from now have stopped rising, reflecting more aggressive central bank tightening and a weaker economic outlook.

In some countries, particularly in Europe, fiscal measures taken by governments to compensate for the rising cost of energy are having an impact.

Rising energy prices were the main driver of inflation in many countries, even before Russia invaded Ukraine. The daily data shows how pressure has intensified following a conflict that has forced Europe to seek alternative gas supplies.

However, wholesale prices have now eased due to weakening global demand and European gas storage facilities being almost filled to capacity.

The pass-through from wholesale prices to consumer prices is not immediate and household and business costs remain high in Europe, where the energy crisis has been more severe due to the region’s greater reliance on gas Russian.

Rising inflation has also spread beyond energy to many other elementsrising food prices particularly affecting the poorest consumers.

Rising prices limit what households can spend on goods and services. For the less well-off, this could cause people to struggle to afford basic necessities such as food and shelter.

Daily commodity data, like the wholesale price of breakfast ingredients, provides an up-to-date indicator of the pressures consumers face. Although they have eased in recent months, they remain at high levels.

In developing countries, the wholesale price of these ingredients has a greater impact on final food prices; food also accounts for a larger share of household expenditure.

Another area of concern is asset prices, especially for homes.

These have soared in many countries during the pandemic, spurred by ultra-loose monetary policy, homeworkers’ desire for more space, and government income support programs. However, rising mortgage rates are already causing a significant slowdown in house price growth in many countries.

https://www.ft.com/content/088d3368-bb8b-4ff3-9df7-a7680d4d81b2

—————————————————-