Featured Sponsor

| Store | Link | Sample Product |

|---|---|---|

| UK Artful Impressions | Premiere Etsy Store |

This article is a field version of our Energy Source newsletter. Sign up here to receive the newsletter directly in your inbox every Tuesday and Thursday

Hello and welcome back to Energy Source.

Chevrons yesterday he said he would buy PDC Energy, a Colorado-focused shale driller, for $7.6 billion is the latest sign that the US oil industry could see a wave of deals. Growth in the shale area is slowing, prospects for primary drilling are becoming increasingly dim, and companies have cash – and in this case rich stock prices – to throw around.

Chevron has spent months pushing back questions about the quality of its shale holdings after the company’s production disappointed last year, and this deal seeks to answer some of those questions. Chevron’s investment in the United States also increases, suddenly placing little-known Colorado oil patch in the top five assets of the global oil powerhouse.

PDC’s decision to sell, meanwhile, reflects how unloved small oil producers are on Wall Street. It’s a complete reversal from the early days of the shale revolution, when newcomers dominated the oil patch and giants like Chevron struggled to keep up. Like other undersized drillers, PDC has seen its shares trade at a persistent discount to its bigger rivals for years, leaving it vulnerable to a takeover. It probably won’t be the last.

Moving on to today’s newsletter: Myles digs into a new survey of energy executives who say low returns on clean energy projects are holding back investment. And Amanda reports that efforts by the United States and other Western nations to extricate themselves from China’s clean energy supply chains will take a decade or more to complete.

Thanks for reading – Justin

Show me the returns

The energy transition is still not proving profitable enough for some.

This is one of the highlights of the Bain consulting firm’s annual survey on the energy transitiona closely watched measure of industry attitudes towards decarbonization, which was released this morning.

ES pre-reviewed the study, which surveyed more than 600 senior executives in the energy and natural resources industry globally. These are our main suggestions.

1. Inadequate returns dissuade capital from transitioning. . .

More than three-quarters of executives surveyed cited limited return on investment and consumers’ unwillingness to pay as a major obstacle to pumping money into clean energy.

“We don’t have a capital shortage, we have a yield shortage,” Joe Scalise, head of Bain’s Global Energy & Natural Resources practice, told ES. “To make these world-changing investments — to raise the capital to make them — there has to be an adequate return.”

“The problem we have here is not that there isn’t a desire to change,” Scalise said. “Every executive I interact with . . . cares about the future of the planet. But they also have fiduciary responsibilities to guard the assets for which they are responsible.”

There’s a lot of money invested in clean energy — hundreds of billions every year — but it’s still nowhere near the trillions needed to meet climate goals. Reaching the next level is hitting a major hurdle: Going green doesn’t always pay off.

Supermajors Shell and BP recently scaled back their plans to switch to renewable energy as profits pile up in their fossil fuel businesses. Despite the huge drop in wind and solar costs in recent years, fossil fuel energy, especially in the environment of last year’s sky-high prices, is where the money is.

If markets are not generating enough returns to trigger a transition of the required scale and pace, it is up to governments to channel capital towards the transition.

2 . . . but government intervention is making a big difference

Where governments are handing out carrots to coax investment, it appears to be working.

The US Inflation Reduction Act – which is injecting $369 billion in clean energy in the form of subsidies and loans – has spurred a massive influx of capital, leaving other nations scrambling to keep up.

Its impact is clear from the survey results: North American executives expect to allocate 22% of capital spending this year to “new growth areas,” up from 19% a year ago. In Europe, where governments have been scrambling to stem the flow of investment westward across the Atlantic, the trend is reversed.

“Nothing repels investment like uncertainty,” Scalise said. “If there’s ambiguity, people hold back. I think there’s a perception that there’s more of it in Europe at this point after the IRA.

If the IRA pits governments against each other in a new arms race for clean energy subsidies, it could squeeze returns and unleash a new wave of spending.

3. The people problem

But even as capital flows towards decarbonisation increase, there is another problem: jobs.

From turbine technicians to panel installers, the energy transition is labor intensive. Executives say finding people to fill those jobs is becoming a problem.

Digital and IT jobs are a particular bugbear for hiring managers. About a quarter of executives surveyed cited an “unfavorable environment” for finding or retaining staff in these areas.

“The Energy and Natural Resources Industry. . . it hasn’t exactly been at the forefront of exciting places for new computer science grads to work,” Scalise said. “It wasn’t really a backwater. But it hasn’t been an exciting place to be for quite some time.”

That attitude is changing today and rapidly. But it’s not just in tech jobs where the problem exists. Filling essential building locations is also proving to be tricky.

“We need more and more frontline workers, more and more people who can employ the capital of the power grid,” said Scalise. “[Many of] these trades have been in decline for several years. But that’s where the money will flow and where the skills will be needed.”

(Myles McCormick)

Data tutorial

President Joe Biden’s efforts to build a clean energy production base in the United States and friendly nations won’t break America’s dependence on China’s critical minerals any time soon, warns a new report by Lazard geopolitical consultancy.

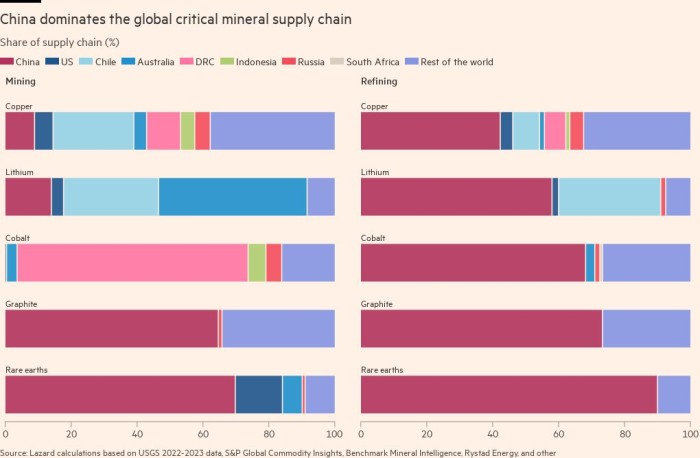

Ensuring enough critical minerals, such as lithium and nickel, needed to fuel the clean energy transition has become a priority in Western capitals as tensions escalate with China, which dominates large swathes of the supply chain.

The United States has made multiple pledges with trading partners to secure critical minerals, and buyers and sellers clubs are emerging to gain more leverage in the market.

The US Inflation Reduction Act uses subsidies to entice companies to source an increasing amount of critical minerals used in electric vehicle batteries from the US or free trade partners. Continuing to rely on China-based supply chains will put automakers at a disadvantage, or so it is thought. The EU has also proposed its own internal thresholds for critical minerals.

The policies, however, won’t quickly resolve a deeply entrenched dependence on China, warns Lazard in his report titled “Critical Minerals: Geopolitics, Interdependence, and Strategic Competition.” Years of underinvestment, long project lead times, and rapidly growing demand mean countries will need Chinese supply for at least the next decade.

“The dependencies and interdependencies that exist between countries are very clear-cut and something that, at least for the next 10 years, will remain so,” said Carlos Petersen, geopolitical consultant at Lazard. “Foreign dependencies won’t end with a policy like the IRA.”

This long transition leaves Western countries in a vulnerable position. China has a lot of leverage to retaliate against Western nations and deprive them of inputs, risking high prices and slowing the transition, Lazard says. Beijing controls most of the mining and refining of rare earths, graphite and silicon, as well as the processing of lithium and cobalt.

“If we were to enter another crisis between the United States and China or the West and China. . . this would be one of the best tools China could use,” said Theodore Bunzel, co-head of Lazard Geopolitical Advisory.

Yet the situation carries risks for Beijing as well. Forceful retaliation from China could backfire, prompting buyers to look elsewhere or invest more in their own domestic supply and technologies. China’s temporary ban on rare earth exports to Japan in 2010 led to a significant reduction in the country’s dependence on China that continues more than a decade later. (Amanda Chu)

Strengths

Energy Source is written and edited by Derek Brower, Myles McCormick, Justin Jacobs, Amanda Chu and Emily Goldberg. Reach us at energy.source@ft.com and follow us on Twitter at @FTEnergy. Stay updated on past editions of the newsletter Here.

Newsletters recommended for you

Moral money — Our must-have newsletter on socially responsible business, sustainable finance and more. Sign up here

The climate graph: explained — Understand the most important climate data of the week. Registration Here

—————————————————-

Source link

We’re happy to share our sponsored content because that’s how we monetize our site!

| Article | Link |

|---|---|

| UK Artful Impressions | Premiere Etsy Store |

| Sponsored Content | View |

| ASUS Vivobook Review | View |

| Ted Lasso’s MacBook Guide | View |

| Alpilean Energy Boost | View |

| Japanese Weight Loss | View |

| MacBook Air i3 vs i5 | View |

| Liberty Shield | View |