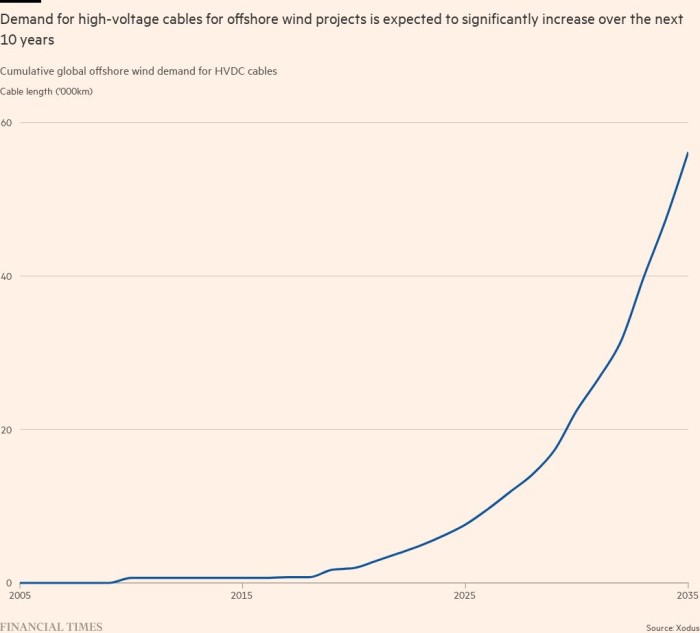

The NeuConnect electricity cable project, which will connect the UK and Germany, is part of a global trend of long-distance cross-border cables, known as interconnectors, to facilitate international energy trading. However, delays in acquiring supplies of electricity cable have pushed back the project’s start date to 2028. Similar delays have been seen in other interconnector projects, raising concerns about supply chain capacity for electricity cable and converter stations. The concentration of suppliers and the difficulty in securing raw materials and skilled labor threaten to slow down the energy transition. High-voltage direct current systems are more efficient for long-distance transportation of electricity, but producing and laying these cables across deep seabeds is a complex process. The demand for high-voltage cables is booming, leading to a concentration of suppliers in the market. There are concerns that manufacturing capacity may not align with the need for new projects to meet net zero targets, potentially leading to a shortage of cables outside of China in the second half of the decade. Rising costs and limited supply are already impacting project budgets and lead times.

—————————————————-

| Article | Link |

|---|---|

| UK Artful Impressions | Premiere Etsy Store |

| Sponsored Content | View |

| 90’s Rock Band Review | View |

| Ted Lasso’s MacBook Guide | View |

| Nature’s Secret to More Energy | View |

| Ancient Recipe for Weight Loss | View |

| MacBook Air i3 vs i5 | View |

| You Need a VPN in 2023 – Liberty Shield | View |

Crossing more than 700km of seabed between the Isle of Grain, south-east England, and Fedderwarden, north-west Germany, the planned NeuConnect electricity cable will enable the two G7 economies to trade electricity directly for the first time.

The £2.4bn project is one of several long-distance, cross-border cables, known as interconnectors, being developed around the world as the shift away from fossil fuels fosters a new era of international energy trading.

Construction on the project started mid-July, helping both countries to try to hit their “climate targets and boost energy security”, Miguel Berger, Germany’s ambassador to the UK, said in a statement.

Progress has not been smooth, however. The cable’s current anticipated start date of 2028 is four years later than initially planned, due in large part to delays in acquiring supplies of electricity cable.

It is not the only such project to be held back. A link between Denmark and Britain has been delayed by problems including “unforeseeable cable market congestion”, while a cable linking France and Spain across the Bay of Biscay is also running one year behind.

There are concerns that this pattern could be a taste of what is to come. Demand for interconnectors and other energy infrastructure such as wind turbines is growing rapidly, putting unprecedented strain on supply chains for electricity cable and the converter stations needed for connection to the grid.

Supplies of both are concentrated among relatively few companies, with high barriers to entry. The potential difficulty of securing raw materials such as copper, and a lack of skilled labour needed for factories, risk putting a brake on new supplies.

Manufacturing slots are booked up, and costs are climbing. “You’re in a dogfight”, says one senior wind industry executive, describing a scramble for converter stations.

“With companies already pointing to long lead times for key pieces of [electricity] grid equipment, lack of supply chain capacity could become a major bottleneck,” warns Ben Backwell, chief executive of the Global Wind Energy Council, a trade association.

Government and industry must work together to add the necessary manufacturing capacity and make sure critical materials are available in the right quantities and at the right price, he adds. “Otherwise we run the risk of sleepwalking into shortages and cost squeezes that could delay or even derail the energy transition.”

A painstaking process

The push away from fossil fuels and towards clean electricity has accelerated in the past few years, with countries putting in place ever more ambitious targets. Russia’s war on Ukraine has underscored the need to move away from gas, sometimes considered a “bridge” fuel.

The International Energy Agency expects renewable power capacity to grow by 2,400 gigawatts between 2022 and 2027 — equivalent to China’s entire power capacity today — with both the EU and the UK targeting multifold increases in offshore wind by the end of the decade.

“We are entering the third electrical infrastructure revolution in Europe,” says Christopher Guérin, chief executive of Nexans, one of the largest cable makers by market share, referring to previous growth spurts at the turn of the 20th century and after the second world war.

The revolution requires vast amounts of new cabling in general. But the distances over which electricity needs to be transported are also getting longer, as developers try to best harness the wind and sun.

In the quest for higher wind yields, turbines are being put ever deeper out to sea. Countries want to be able to buy electricity from those with sunnier or windier weather. Many also need to be able to trade electricity minute by minute with others in different time zones and weather patterns, to smooth out surges and lulls in supplies depending on how hard the wind is blowing or the sun is shining. Electricity supply and demand must be constantly matched, to avoid blackouts.

Several projects, such as NeuConnect, are set to expand Britain’s electricity ties to the continent. Other long-distance cables being built include the 400km link between Cubnezais in south-west France and Gatika in northern Spain, and the 1,208km EuroAsia Interconnector running from Israel to Cyprus and Greece.

Transporting electricity can be inefficient, however, with losses along the way worsened over large distances. Sending it at very high voltage is more efficient, if more expensive, with losses potentially as low as 3 per cent per 1,000km for direct current systems, which have less resistance. This is about 30-40 per cent lower than for alternating current systems.

“HVDC [high-voltage direct current] becomes economic at about the 60km mark” for subsea systems, says Ian Douglas, chief executive of cable company XLCC.

Producing cables that can do this across deep and uneven seabeds is a complex, painstaking process. Strands of copper or aluminium conductor are wrapped in several layers of insulation and protection, such as paper steeped in non-conductive fluid, lead coating, plastics and steel.

Production typically ekes along at about one metre per minute. Precision is key. “If you have, let’s say, one grain of sand inside, the cable will fail,” says Frank de Wild, senior consultant in power cables at the consultancy DNV. Laying them at the bottom of the sea is another challenge, requiring special vessels and highly skilled crews. The largest cablemaker by market share, Prysmian Group, has a ship that is 171 metres long and equipped to lay cables at up to 3,000 metres deep.

Notwithstanding these complexities, demand for high-voltage cables is booming, with the market climbing from a typical $3bn of new projects awarded per year between 2015-20 to $11bn in 2022. This year, the estimated value of new orders is likely to exceed $20bn before settling at $18bn-$20bn per year, according to Massimo Battaini, incoming chief executive of Prysmian. “We are fully booked until 2026/27,” he says.

Historically stable demand, as well as high barriers to entry given the technical expertise and equipment required to make and install the cables, means the market is relatively concentrated. Milan-based Prysmian, NKT, which is based in Copenhagen, and Nexans in Paris account for more than 75 per cent of the market. They are investing heavily to meet demand, while competitors new and existing are also trying to muscle in.

But some analysts doubt manufacturing capacity will align with the rapid pace at which new projects need to be built to meet net zero targets.

The consultancy 4C Offshore estimates current plans will result in a shortage of high-voltage cables outside of China in the second half of the decade. (China has domestic manufacturers which mostly supply the Chinese market.)

“On very simple maths, when you look at projects and the lengths, and the connection dates, and when you start to marry those numbers up, you have a shortfall,” says Chris Smith, at the consultancy PSC.

An era of scarcity

Strains are already starting to show. Rising costs of cables and converter stations have helped push up the budget for the delayed Bay of Biscay project from €1.75bn to €2.85bn. An insider at Inelfe, the project’s developer, points to HVDC “market saturation, due to the unprecedented demand for offshore wind and interconnection projects”.

National Grid, the FTSE 100 company that owns and runs Britain’s transmission system and is developing new cables to the continent, says it is “operating in a constrained market” driven by “a limited number of suppliers globally”.

“Demand is outstripping supply as other countries catch the UK up and push ahead with their own energy transition,” the company adds.

Danielle Lane, director of development for the UK and Ireland at German wind group RWE, says lead times for HVDC converter stations have jumped to up to seven years. “Availability is a significant risk,” she says. “We’re competing with grid operators as well as other developers.”

Those with the biggest buying power are flexing their muscles. Rivals bristled last month when TenneT, the Dutch-state-owned company which owns and runs electricity cables in the Netherlands and Germany, signed agreements worth €5.5bn for 7,000km of electricity cables from Nexans, NKT and others, for wind projects.

“I think this partially requires a national approach,” says Keith Anderson, chief executive of Scottish Power, the UK-based developer. “In Germany, they’ve pulled together a long-term plan which they can take out to the market to book manufacturing slots . . . where is the UK’s version of this plan?”

Last year, TenneT awarded contracts for converter stations to a consortium involving two subsidiaries of China’s state-owned State Grid, despite sensitivities in Europe over China’s involvement in critical national infrastructure projects.

“Geopolitical threats are analysed jointly by the government and TenneT,” the company says. “We exclude deep insights into the functioning and technical details of our grid monitoring.”

While demand for high-voltage cabling is particularly acute in Europe, grid operators in the US are also facing difficulties getting equipment. Last year the US Department of Energy flagged a “shortage of transformers and other grid components”.

Lead times for electricity parts have “gone through the roof”, with waits of three to four years for large power transformers, says Stephanie Crawford, regulatory affairs director at the National Rural Electric Cooperative Association. “Members are having to either delay or defer projects either to just maintain or upgrade their current system,” she says.

In Goose Creek, South Carolina, Nexans has revamped its factory to help supply the growing demand for high-voltage cables for offshore wind farms in the US, one part of wider investment plans.

But chief executive Guérin is cautious about investing in too much new capacity, given the risks ahead including the supply of raw materials, copper in particular.

Inside a HVDC cable

-

High-purity copper or aluminium conductor

-

Semi-conducting paper tape layer

-

Insulation layer impregnated with a viscous insulating oil

-

Semi-conducting paper tape layer

-

Lead alloy sheath

-

Polyethylene jacket

-

Metallic tape reinforcement

-

Synthetic tape layer

-

Single or double layer of steel armour wires

-

Polypropylene yarn outer coating to protect the cable

The cables are typically 110mm-140mm in diameter and weigh between 30kg and 60kg per metre

Source: Entsoe-e

Company research points to a shortfall of 3mn-5mn tonnes of copper in the middle of the decade, as power grids, wind turbines and electric cars hoover up supplies.

“We want to make sure that beyond each individual contract we sign, we have the full sourcing of the copper and aluminium behind it,” he says. “Before there was an era of abundance; now we are shifting to an era of scarcity.”

Guérin has recently returned from a trip to Chile, signing a five-year deal for copper supplies with miner Codelco, worth more than 100 kilotonnes of the metal per year. The deal is “evergreen”, meaning it is automatically extended unless either party renounces it.

Skills shortages are also a risk. “The biggest bottleneck we have to implement projects is in skills,” says Tim Holt, a member of the managing board at Siemens Energy, which supplies transformers and other products for HVDC systems.

In the space of a year, Siemens Energy has gone from having spare slots to lead times of three to four years for its large transformers. “In engineering we hired 700 people alone last year,” Holt adds. “Execution of these multibillion [dollar] projects requires numerous professionals with years of experience.”

He is also cautious about investing in extra output, given past experience. “There was quite a bit of overcapacity in the industry in the 2010s and then we all reduced capacity together,” he says. “Without full planning certainty, there is now a reluctance to create too much new capacity too quickly.”

Manufacturers’ desire for certainty can pose challenges for renewable developers who often have to jump through several hoops, such as planning permission and subsidy auctions, before they are certain projects can go ahead.

“It’s really a timing issue,” says Julia Prescot, chair of the board at NeuConnect. “While the supply may be there, the time that it’s going to take to be implemented — that’s going to be the risk.”

Battaini, at Prysmian, which is making the cables for NeuConnect, says the company is in “constant dialogue” over customers’ needs, and will invest to maintain its market share.

“Customers are in a kind of panic mode,” he says. “They realise that if [they don’t] move faster than the market, their capacity will be booked by someone else. So they are kind of participating in our investment and giving us a downpayment for volume.”

This puts the company in a strong position. “We can price cables with more headroom price-wise than we used to have in the last 10 years,” he adds.

The market is starting to adapt. Several planned projects in the UK are on course to reverse cable plant closures over the past few decades. Douglas’s XLCC is planning to build the UK’s first HVDC factory, in Ayrshire, Scotland, which should open in late 2027 to supply projects including a potential 3,800km link between Morocco and the UK.

“We’re going to show that you can get huge efficiencies from building a dedicated HVDC factory with effectively one product, which means we can get to market quickly,” he says.

Japan’s Sumitomo Electric Industries in April also revealed plans for a factory in Scotland, while financier Edi Truell’s Global Interconnection Group is eyeing a new one in the Port of Tyne, to support a potential link to Iceland.

Manufacturer JDR Cables, meanwhile, is building a new high-voltage cable plant in Cambois, Northumberland. They have found ways to be less reliant on copper. “We’ve developed and tested aluminium cables, so the array cables could switch to aluminium,” says James Young, chief strategy officer at JDR. XLCC also uses aluminium, not copper, in part because it is lighter.

Converter suppliers such as Hitachi Energy have also been standardising their processes so they can scale up. “There are huge efficiency gains that can be made,” says Niklas Persson, managing director of Hitachi Energy’s grid integration business.

But timelines are uncertain and competition is fierce. Prescot, at NeuConnect, warns developers are in for a tough ride.

“You have to be very clear that you are determined and have the money to do it,” she advises. “When you go into a global market like this, suppliers have choices.”

Data visualisation by Felix Wallis

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

—————————————————-